A Life-long Investment That Costs Less Than You Think

Stocks. Bonds. Real estate. There are numerous ways people secure their future by investing in commodities that appreciate. But diamonds?

YES.

Brilliant! Literally. Here’s why:

Though not on the typical “investments short list”, diamonds are actually an excellent addition to your portfolio. And they’re much more fun, since you get to wear them about and enjoy the sparkle they lend to every occasion. Not something you can say about your shares of easyJet.

Why are diamonds such a wonderful investment? They’re rare. Naturally-occurring diamonds are precious and limited, and the process of their mining and their preparation is time-consuming, requiring many hands at work.

And although diamonds may evoke images of a luxury lifestyle that may not be yours, in reality, diamonds are an affordable investment. This is particularly true when compared to something like real estate, which may be out of reach for many people – especially younger generations like Millennials.

But it’s not just ANY diamond that makes a good investment. Just like buying stocks and real estate, you have to choose wisely.

WHY NOW IS THE TIME TO INVEST IN DIAMONDS

When you’re shopping for jewellery like diamond stud earrings as a gift, or a diamond engagement ring to accompany popping the question, there are certain criteria to consider, known as the “4 C’s”. You’ve likely to have heard about them – carat, clarity, colour and cut, but may not know too much beyond the basics. We’re about to demystify each and help you understand what will give you the biggest return down the road.

But first, a couple of important notes to keep in mind:

✔ LARGER DIAMONDS OF HIGHER QUALITY WILL ALWAYS APPRECIATE.

Case in point, The Week reported “From 1990 to 2011, the value of three-carat diamonds increased by 145 per cent, while five-carat diamonds rose by 171 per cent on the Rapaport Diamond Trade Index (a carat is 0.2 grams).”

✘ SYNTHETIC (“LAB-GROWN” OR “CULTURED”) DIAMONDS ARE NOT THE WAY TO GO.

They’re so easy to create the market is flooded with them, which drives their value down while the value of naturally-occurring rare diamonds climbs that much higher. Thus, natural diamonds are always what you want.

In fact, Wired reported, “According to Bain & Company’s extremely thorough sector report, demand for natural diamonds is expected to grow at an average annual rate of 5.9 percent until 2020, while supply is only expected to grow by an average annual rate of 2.7 percent.”

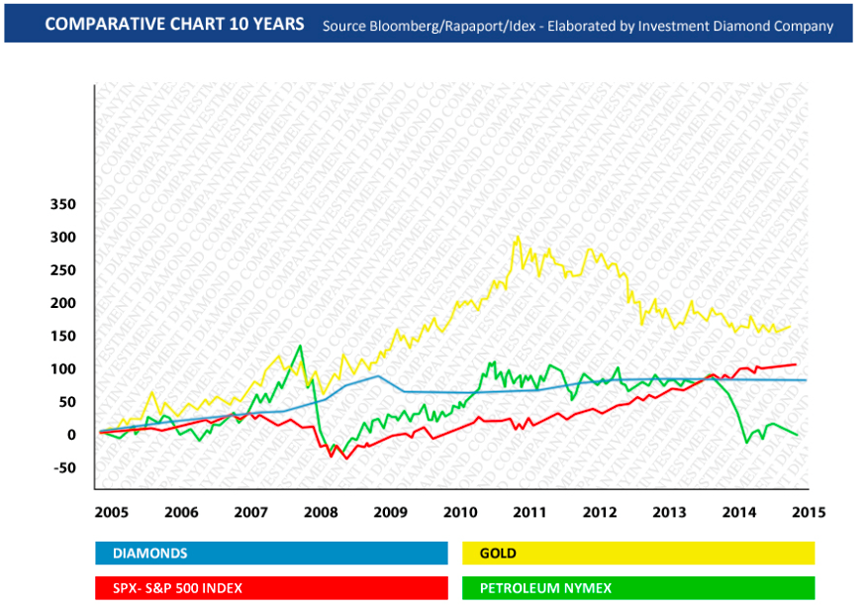

When you look at value over the past ten years you can see that diamonds have held steady where other commodities have fluctuated wildly. That’s because “diamonds are one of the commodities subject to minimum price volatility.” [source: The Market Mogul]

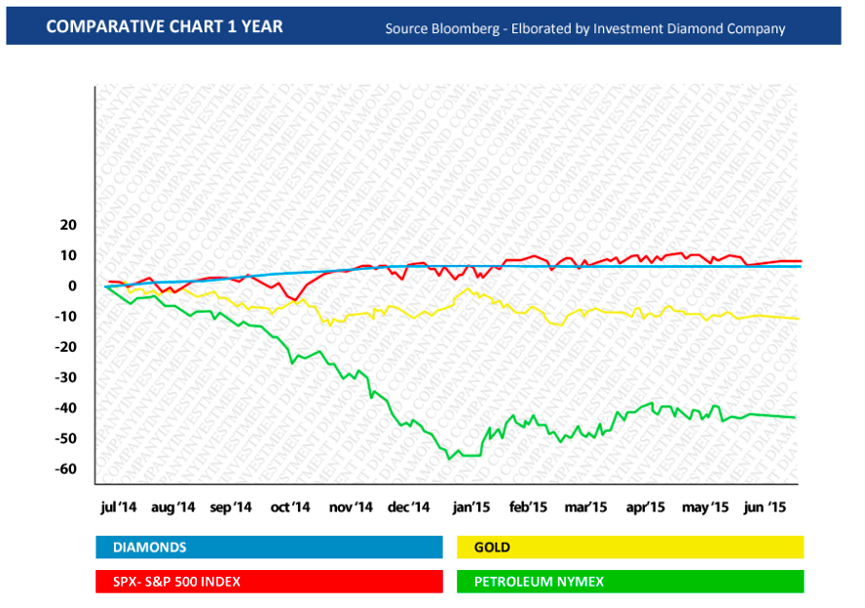

This is really evident when you look at the changes in all categories over a one-year period:

“According to the official forecasts made by McKinsey & Company, the average growth [that] diamonds demand, priced in US dollars, should be around 6% per year for the 10 upcoming years.” [source: The Market Mogul]

So the time to shop is now.

THE 4 C’S

But because diamond appraisals are partly subjective, being sure your diamond rings and other diamond jewellery are of the highest quality is that much more important. This is where the 4 C’s really come into play:

Carat – When considering the weight of a diamond, “more is more” since “bigger” diamonds hold their value better than smaller.

Clarity – Some diamonds may contain flaws which are broken into two categories

- Blemishes – surface flaws like scratches and chips

- Inclusions – internal flaws like air bubbles, cracks, clouds, etc

The fewer the flaws, the greater the value of the diamond.

Colour – Colour-less is actually what you seek here, or what is called “exceptional white” (grade D) and “rare white” (grades E, F, and G). These pure white diamonds are of highest value.

Cut – It’s not just about shape preference. Cuts which are too shallow or too deep can negatively impact the symmetry, fire and brilliance of a diamond – which also negatively impacts its value. “Ideal” or “excellent” graded cuts are best.

The last – but still crucial – consideration is WHERE to buy your diamonds. GIA or IGI certified is an indicator to insist upon. Both the Gemological Institute of America Inc. and the International Gemological Institute are recognized authorities, so buying a diamond with a certificate issued by either means you can rest assured your diamond is of the highest quality. Shining Diamonds offers this option, as well as our own certificates, which are issued by a GIA qualified gemologist.

And you’ll want to approach your diamond purchase as you would buying stocks, meaning “buy low, sell high.” And buying diamonds online allows you to do just that.

Have more questions about investing in diamonds? Ask us here!